Fixed Indexed Annuities

Learn more about different types of annuities and their trade-offs in Annuities in Retirement, so you can decide if this is the best way to turn your assets into income.

What is a fixed indexed annuity?

When you’re looking for upside potential with downside protection

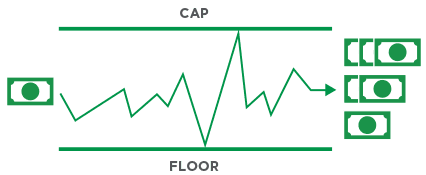

A fixed indexed annuity is a tax-deferred, long-term savings option that provides principal protection in a down market and opportunity for growth. It gives you more growth potential than a fixed annuity along with less risk and less potential return than a variable annuity.

Returns are based on the performance of an underlying index, such as the S&P 500® Composite Stock Price Index, a collection of 500 stocks intended to provide an opportunity for diversification and represent a broad segment of the market. While the benchmark index does follow the market, as an investor, your money is never directly exposed to the stock market.

What are the benefits?

Tax deferral

Its tax-deferred status allows you to benefit from compounded growth.

Principal protection

The original deposit will not decline if the index performs negatively. Please keep in mind, though, that all guarantees are subject to the claims-paying ability of the issuing insurance company.

Flexibility

Growth potential can be achieved through the performance of the index or through a fixed interest rate earned on the fixed account — or a combination of the two. Your investment professional can help you find the best combination for you.

Beneficiary protection

You can pass assets to beneficiaries and avoid costly probate. Optional riders, available for an additional cost, can enhance the amount your beneficiaries may receive.

Spousal opportunities

Most companies offer spousal continuation only upon the first spouse’s death and don’t pay a death benefit out until the second spouse passes. However, some carriers do offer a joint option that may cover the death of either spouse upon the first passing.

Lifetime income

A rider is often available for an additional cost to guarantee set payments regardless of how long you and your spouse (if elected) live. Or, get lifetime income through annuitization at no additional cost.

Earnings credited

At the end of each term, earnings are credited; at that point, they may be affected by negative index performance. Earnings can, however, be limited by the policy’s spread or cap rates. Some carriers may offer a feature that allows you to take advantage of index highs during your term.

What should you consider before purchasing?

Gains can be limited

With this type of annuity, gains can be limited by elements such as participation, caps and interest. However, this product does have some protection from down markets.

Caps

To offer you both opportunity and protection, some indexed annuities have a maximum rate, or cap. You’re also protected against losses.

| Cap | Index performance | Increase to your annuity value |

|---|---|---|

| 5% | +8% | 5% |

| 5% | +5% | 5% |

| 5% | -3% | 0% |

Complexity of plans

The jargon for fixed indexed annuities can be tough to understand, so your financial professional can guide you. The following can help:

Participation rates

The participation rate is how much of an index increase you actually receive. The higher your participation rate, the more of an index performance you’ll receive.

| Index performance | Your participation rate | Your earnings |

|---|---|---|

| 10% | 80% | 8% |

| 5% | 80% | 4% |

| 20% | 50% | 10% |

Fee (also margin or spread)

The fee is generally subtracted from the earnings. As explained in the previous section about “caps,” you’re also protected against losses.

| Index performance | Your participation rate | Your earnings | Fee | Your earnings after fee deduction |

|---|---|---|---|---|

| 12% | 75% | 9% | 2% | 7% |

| 5% | 80% | 4% | 2% | 2% |

| -5% | 80% | 0% | 2% | 0% |

Fixed annuities are contracts purchased from a life insurance company. They are designed for long-term retirement goals. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty.

Imagine Financial Solutions Location

Austin, Texas

6500 River Place Blvd, Bldg 7 Suite 250, Austin, TX 78730

Office: (713) 714-1665

Cell: (713) 398-0431