Blogs

“Third-Party Posts”

The views reflected by the author in this article are subject to change at any time without notice. Imagine Financial Solutions deems reliable any statistical data or information obtained from or prepared by third-party sources included in this article, but in no way guarantees its accuracy or completeness.

Retire with confidence: Master your finances and lifestyle

Discover steps to help you prepare for retirement Imagine this: After decades of hard work and dedication, you’re just 12 months away from the retirement of your...

7 Strategies for More Income in Retirement

“Old age is always fifteen years older than I am.” —Bernard Baruch, American financier, investor, statesman and philanthropist One of the biggest fears people have is...

How an annuity can help as you plan for retirement

As you approach retirement, you may be wondering what are the next steps for your investments. An annuity may be an effective tool for you in retirement planning by...

9 Ways Retirement Will Be Different in 2025

How changes in Social Security, Medicare, 401(k) contributions and more will affect your finances Retirement is not static. Even when the kids are gone and the career...

Important Tasks & Decisions for Each Phase of Retirement Planning

Important Tasks & Decisions for Each Phase of Retirement Planning Retirement. It tends to be a catch-all word that generally refers to the light at the end of the...

Retirement Challenges in 2025: Market Volatility, Inflation and Social Security

Inflation, uncertain markets and a limited Social Security COLA are among the financial hurdles for retirees in 2025. Key Takeaways High interest rates may complicate...

3 Social Security Changes Retirees Need to Know About in 2025

Key Points A modest cost-of-living adjustment (COLA) will make benefit checks bigger. Note that higher earners will pay a bit more in Social Security taxes. Retirees...

If you’re nearing retirement, these 2025 changes could affect your finances. Here’s what to know

Key Points If you’re nearing retirement, key changes for 2025 could affect your finances, according to advisors. Starting in 2025, there’s a higher 401(k) plan catch-up...

A Checklist for Retiring in 2025

Our checklist for retiring next year includes everything you need to do before the retirement party. Only you can know if you're ready for a checklist for retiring in...

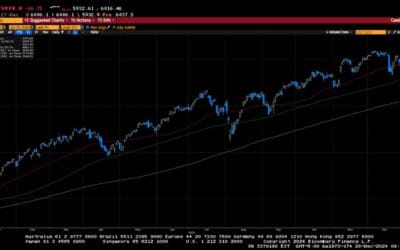

Weekly Market Commentary

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 hit all-time highs, but late in the week, the move abruptly succumbed to consolidation pressure....

Weekly Market Commentary

-Darren Leavitt, CFA Despite all of the uncertainties within the investment landscape, global markets were able to post nice gains last week. Fourth-quarter earnings...

Weekly Market Commentary

-Darren Leavitt, CFA Uncertainty about global trade continued to be at the top of investors' minds as Trump announced 25% tariffs on Mexico and Canada while levying 10%...

Weekly Market Commentary

Darren Leavitt, CFA US financial markets were extremely busy last week as a rush to download a Chinese AI platform called Deep Seek from Apple’s App Store seemingly...

Weekly Market Commentary

Darren Leavitt, CFA Wow, what a week! US markets were closed on Monday for Martin Luther King Jr. Day, and Donald Trump was inaugurated as the 47th President of the...

Weekly Market Commentary

-Darren Leavitt, CFA Financial markets advanced this week as a solid start to the fourth-quarter earnings season, and some better-than-feared inflation data gave...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets fell in the first full week of 2025 as investors recalibrated their Federal Reserve monetary policy expectations. Stronger labor...

Weekly Market Commentary

-Darren Leavitt, CFA The final trading sessions for 2024 extended losses from the prior week, but the S&P 500 and NASDAQ still posted impressive gains for the year,...

Weekly Market Commentary

-Darren Leavitt, CFA Market action was mixed in a holiday-shortened week of trade. The Santa Clause rally, which runs for the last five trading sessions of the year...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Marlene Wanzong) or (Imagine Financial Solutions) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Imagine Financial Solutions.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Weekly Market Commentary

US markets rebounded from losses in the prior week as trade tensions between the US and China appeared to ease. President Trump is scheduled to meet with President Xi...

QCDs and RMDs Before Roth Conversions: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: I read your blog titled “5 Things You Need to Know About Qualified Charitable Distributions.” I was surprised that you didn’t...

Good Reasons to Name a Trust as IRA Beneficiary

When a trust is named as beneficiary of an IRA, several possible negative issues may be introduced. For example, after the death of the IRA owner, things can become...

State Tax Treatment of 529-to-Roth IRA Rollovers

By Ian Berger, JD IRA Analyst By now, most of you probably know about the SECURE 2.0 Act provision permitting 529 funds to be rolled over to Roth IRAs. Because of this...

Roth Conversions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Hello Ed Slott Team! I have been doing backdoor Roth IRA conversions for years now. I recently inherited...

5 Steps for Tax-Free Roth IRA Distributions

By Sarah Brenner, JD Director of Retirement Education The benefit of funding a Roth IRA is the availability of tax-free distributions in the future. You pay taxes now...

401(k) RMD Rollover Problems…and a Last-Minute Save!

By Andy Ives, CFP®, AIF® IRA Analyst 401(k) custodians are usually pretty good about distributing required minimum distributions (RMDs) from the plans they oversee....

Another Way to Lose IRA Bankruptcy Protection

By Ian Berger, JD IRA Analyst Normally, if you declare bankruptcy, your IRA funds (traditional and Roth) are completely off limits to bankruptcy creditors. But a recent...

October 15 Deadlines Are Approaching

By Sarah Brenner, JD Director of Retirement Education October is almost here. This means fall is in full swing. Along with pumpkin spice lattes, football season, and...

The views reflected by the author in this article are subject to change at any time without notice. Imagine Financial Solutions deems reliable any statistical data or information obtained from or prepared by third-party sources included in this article, but in no way guarantees its accuracy or completeness.

Many people assume that their family members would automatically be able to make decisions about medical treatments if they were to become incapacitated. But rules vary... Discover 6 ways to access care fast, even if your doctor is busy. Hint: You may not need to go in person. Doctors’ offices are busier than ever these days. Sometimes it... Expensive medications? You’ll save thousands. Dementia or mental health care? More options Key takeaways Changes from Inflation Reduction Act are in effect now.... A bumper crop of revisions, including a stronger drug benefit, means the plan you enrolled in for 2024 may not be the best fit next year. Americans on Medicare will see... Big changes to Medicare plans are in store for 2025 as open enrollment is underway. Medicare is a federal health insurance program for older adults ages 65 and older.... Key lessons learned from the 2025 Medicare Annual Enrollment Period (AEP); plus actionable strategies for Medicare Advantage plans looking to improve member experience... “How much can I expect to pay out of pocket for Medicare coverage?” It’s something you might be wondering if you’re age 65+ or about to turn 65. Medicare expenses are a... Key takeaways: The Medicare Part D coverage gap known as the “donut hole” will end in 2024. As of January 1, 2025, Medicare Part D plans will have a $2,000... Two important changes are coming for Medicare Part D beneficiaries in 2025 as a result of the Inflation Reduction Act: Annual out-of-pocket (OOP) cap of $2,000 for...

Preparing for Future Health Care Needs

Get the care you need quickly when you’re sick

7 Medicare Changes You’re Seeing in 2025

It’s Time to Shop for Medicare, and 2025 Brings Big Changes

5 big changes to Medicare 2025 plans you should know during open enrollment

Capturing the Opportunity: Medicare Advantage Trends to Watch in 2025

What You’ll Pay in Out-of-Pocket Medicare Costs in 2025

The Medicare Part D Donut Hole Disappears in 2025

What You Need to Know About Changes to Medicare Part D in 2025