Blogs

“Third-Party Posts”

The views reflected by the author in this article are subject to change at any time without notice. Imagine Financial Solutions deems reliable any statistical data or information obtained from or prepared by third-party sources included in this article, but in no way guarantees its accuracy or completeness.

Safe Money Options Heading Into 2026

A Financial Advisor’s Guide to Protecting What You’ve Worked So Hard to Build When markets are choppy and headlines are loud, many people start asking the same...

Retirement Income Planning Going Into 2026: Turning Your Savings Into a Lifetime Paycheck

For most people, retirement isn’t about a specific age or account balance—it’s about confidence.Confidence that the bills will be paid, that you can handle surprises,...

Estate Planning & You: Getting Ready for 2026 (Without Freaking Out)

state planning sounds like something for billionaires in marble mansions… not for regular people with a mortgage, a 401(k), a dog, and a favorite taco spot. But here’s...

Retirement Planning in 2026: How to Prepare for a New Era of Retirement

If you feel like retirement has gotten more complicated, you’re not imagining things. Between market volatility, rising costs, new tax rules, and longer life...

Retirement Planning in 2026: A Practical Playbook (and How Annuities Can Help)

TL;DR: Going into 2026, retirees face two big realities: markets that still swing and a shifting tax landscape. Focus on dependable income, flexible tax buckets, and a...

Retirement Planning Heading Into 2026: 7 Smart Moves For Clients Right Now

As 2025 winds down, retirement planning is shifting under three big spotlights: taxes in 2026, retirement plan rule updates, and Medicare drug-cost changes. Here’s a...

Why Life Insurance Belongs in Your Retirement Plan

Quick Take Life insurance isn’t just for parents with mortgages. The right policy can: protect a spouse’s income plan if one Social Security check disappears create...

Annuities 101: Why They’re (Sometimes) a Great Idea for Retirement

Quick Take Annuities are insurance contracts that can turn a portion of your savings into guaranteed income you can’t outlive. For the right person, they lower stress,...

Retirement Income Planning: A Practical Guide for Turning Savings Into a Sustainable Paycheck

Key Takeaways (TL;DR) Retirement success is less about “the number” and more about cash-flow durability, tax efficiency, and risk control. A resilient plan blends...

Weekly Market Commentary

US markets finished the week mixed, with a late-week rally in technology mitigating early-week losses. Micron Technology’s third-quarter results were excellent and...

Weekly Market Commentary

The Federal Reserve, as expected, cut its monetary policy rate by twenty-five basis points to 3.50%-3.75% and tempered expectations for further cuts in 2026. The...

Weekly Market Commentary

Apprehensive investors pushed markets higher this week, with the small-cap Russell 2000 hitting a new all-time high, while the S&P 500 closed just 50 points below...

Weekly Market Commentary

The holiday-shortened week saw global financial markets trade higher. Increased optimism for a December rate cut, along with some constructive news on the AI front,...

Weekly Market Commentary

Financial markets continued to decline as investors sold AI-related stocks amid valuation concerns, while rotating into more defensive sectors such as healthcare and...

Weekly Market Commentary

Markets were choppy and ended the week with mixed results. Investors poured into risk assets on the idea that the longest US government shutdown was over, but a more...

Weekly Market Commentary

Well, the market finally had a significant pullback, but not before the S&P 500 and NASDAQ were able to set another all-time high. The week began with a deal...

Weekly Market Commentary

Investors sent US markets to another set of all-time highs despite concerns about an extended government shutdown. The U.S. government shutdown was largely dismissed...

Weekly Market Commentary

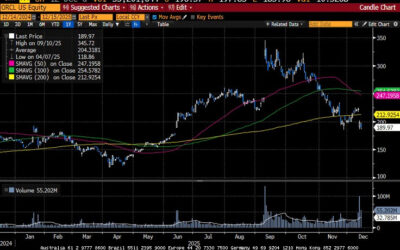

The S&P 500 hit a 28th record high for the year before settling lower for the week. Investors endured a choppy week of trading as better-than-expected economic data...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Marlene Wanzong) or (Imagine Financial Solutions) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Imagine Financial Solutions.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

SIMPLE Plan Contributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello, I am searching for confirmation that Roth SIMPLE IRA contributions are not limited by modified adjusted gross...

Making Sense of the Roth 401(k)-to-Roth IRA Rollover Rules

By Ian Berger, JD IRA Analyst One of the most common retirement account transactions – rolling over Roth 401(k) funds to Roth IRAs – is also one of the most complicated...

How Your RMD Statement Can Help You

Sarah Brenner, JD Director of Retirement Education The rules for required minimum distributions (RMDs) can be complicated and, under the law, the responsibility...

Taxes on Required Minimum Distributions and Qualified Charitable Distributions from Trusts: Today’s Slott Report Mailbag

Ian Berger, JD IRA Analyst Question: Does a non-spouse eligible designated beneficiary (EDB) have to pay taxes on required minimum distributions (RMDs) either at...

2026: Here We Go Again!

By Andy Ives, CFP®, AIF® IRA Analyst It’s a new year, and the slate is wiped clean. Here we go again! While we are only one week into 2026, there are some important IRA...

Coming Soon: The Thrift Savings Plan Will Start Offering In-Plan Roth Conversions

By Ian Berger, JD IRA Analyst Since 2010, participants in certain private sector 401(k) plans have been able to boost their Roth retirement savings by doing an “in-plan...

Best of the 2025 Slott Report

By Sarah Brenner, JD Director of Retirement Education ‘Tis the season for lists! Best TV shows, best of music and best podcasts. The lists go on and on. In the spirit...

Grinch Gifts: Penalties and Missed Opportunities

By Andy Ives, CFP®, AIF® IRA Analyst The Grinch likes it when things go horribly wrong. He likes it when rambunctious pets tip over Christmas trees. He likes it...

Holiday Cheers and Jeers

By Ian Berger, JD IRA Analyst In the spirit of the holiday season, here’s a list of cheers and jeers for the IRS and Congress: Cheers to the IRS: To its credit,...

The views reflected by the author in this article are subject to change at any time without notice. Imagine Financial Solutions deems reliable any statistical data or information obtained from or prepared by third-party sources included in this article, but in no way guarantees its accuracy or completeness.

If you’re approaching 65, already on Medicare, or helping a loved one evaluate coverage, you’ve probably noticed something: Medicare Advantage plans are everywhere. And... What to Know About Filling the Gaps in Original Medicare If you’re approaching Medicare or already enrolled, you’ve probably noticed something surprising:Original... If you’re on Medicare — or getting close — you’ve probably heard people talk about “Medicare Supplement” or “Medigap” plans. You’ve also probably heard…👉 “Plan... If you’re turning 65, there’s a good chance you’re not retiring the way your parents did. Many of today’s 60-somethings are still working, consulting, starting... Choosing or changing your Medicare coverage isn’t something to rush. Each year, your health needs, prescriptions, and budget can shift—and plans change too. Use this... 1) Waiting too long to enroll If you miss your Initial Enrollment Period (the 7-month window around your 65th birthday) and don’t have qualifying employer coverage, you... Snowbird Medicare: A Two-State Plan That Actually Works If you split the year between two homes, you already know about duplicate utility bills and the art of packing... Medicare doesn’t have to be confusing. Use this simple month-by-month checklist to enroll on time, avoid penalties, and choose coverage that fits your doctors,... If you’re approaching 65, already on Medicare, or helping a parent navigate coverage, you’ve probably noticed two things: The rules change often, and 2) small choices...

Medicare Advantage Heading Into 2026: What You Need to Know Before You Enroll

Medicare Supplement Plans (Medigap) for 2025–2026

Medicare Supplement Plans in 2026: What’s Changing, What’s Not, and What It Means for You

Working Past 65? The New Rules of Medicare for Today’s “Unretired” Americans

Your Annual Medicare Checklist: What to Review Before You Change Plans

7 Costly Medicare Mistakes (and How to Avoid Them)

“Snowbird Medicare: A Two-State Plan That Actually Works”

Turning 65? The No-Stress Medicare Timeline (What to Do & When)

7 Smart Moves to Cut Health Costs and Get Better Coverage with Medicare (and the Right Insurance Pairings)